Previous Story: Episode 02 No One will Buy Unless the Old House is Demolished?

Family and relatives gathered again at Yoko’s father’s house because of the his 49th-day memorial service. After many discussions, they decided to sell the house. There are many questions to ask. How much is this 90-year-old house worth? How difficult is it to sell? What can we do with the fields and lands? What was the reply from the real estate agents?

Yodoe Project Episode 03 Prologue

Nine months had passed since Yoko’s father, Shigeru, passed away. Yoko and her brother Shu completed the inheritance procedures and submitted the paperwork to the tax office, although they had some regrets about certain things that should have been done when their mother passed away and while their father was still living. While preparing this paperwork, they also learned about Japanese agriculture, its terminology, and some concerns. Is the future of Japanese agriculture viable? They wander around Yodoe while discussing it. What should we do now?

Are We the Subject of Inheritance Tax Return?

Yoko’s father Shigeru loved reading books and had not hesitated to spend money on them since his youth. The main house and annex were filled with books, including his collection and those he bought for his children.

Since he was an English and Social Science teacher, many books were about the global situation, history, literature, and art. When Yoko and her brother were little, Shigeru read for his children daily.

He also loved traveling. During summer break, he and his family traveled all over Japan, including Hokkaido and Kyushu. Due to this experience, Yoko also developed a love of traveling. After she became a junior high school student, Shigeru also started traveling overseas by himself.

Even though he spent money on books, traveling, and lessons for children, he always saved money diligently in various ways. He didn’t drink or smoke. He had no driver's license and always used public transportation or a bicycle.

Believing that his wife, Keiko, would live longer than himself, Shigeru devised ways to ensure that she would have some assets after he died.

After Keiko passed away in 2009, Shigeru wished to inherite all the assets he had saved for her. Respecting the father’s wish, Yoko and Shu signed the paperwork for the abandonment of inheritance without checking the amounts. If they had inherited the money at that time, they may not have needed to pay the inheritance tax now.

At the time Keiko passed away in 2009, the borderline for the basic reduction regarding inheritance tax was 70 million yen for two legal heirs and 80 million yen for three. However, the tax system had changed by January 1, 2015, and its borderline was lowered.

30 million yen + (6 million yen x 2 legal heir) = 42 million yen

After researching and calculating their inheritance (savings, lands, and buildings), Yoko and Shu discovered they might need to pay the inheritance tax since those exceeded the borderline for exemption.

Converting Farmland to Residential Land Is Not That Easy!

Shigeru passed away on September 23, 2017. The inheritance tax return must be filed within 10 months from the day of finding out about the decedent’s death. So Yoko and Shu had to finish everything by July 23, 2018.

A half-year after their father’s death, between March 18 and 21, 2018, Yoko and Shu gathered in Yodoe again. In addition to visiting their father’s grave, they decided to do detailed research to determine whether they needed to pay the inheritance tax.

“To make sure what real estate staff said is valid, why don’t we visit an Agricultural Committee to find out whether or not we can transform the farmlands into residential land?”

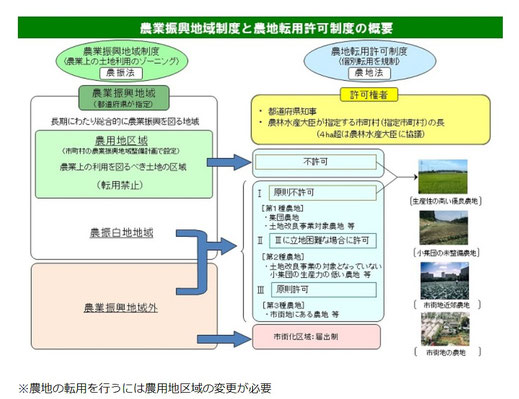

They visited the Yonago City Agricultural Committee together and learned a lot of information. According to the committee, there are two types of farmlands: “Aochi (farmland within the agricultural promotion area)” and “Shirochi (farmland outside the agricultural promotion area).” The land they inherited was Shirochi.

There are also several kinds of Shirochi: Type 1 farmland cannot be converted to other uses, but type 2 is slightly more likely to be approved. However, they also discovered that it is even more difficult for them to transform the farmlands into residential lands since their inherited land is outside the urbanization control area.

The rice field (3,463 square meters/73,275 square feet) located across Route 9 was determined to be Type 1 farmland since it was not surrounded by public roads and was connected to farmland in Daisen Town. In that case, converting the land for businesses subjected to the Land Acquisition Act, such as schools and welfare facilities, is the only choice. Even if that happens, it takes a considerable amount of time to do so.

In addition, they found out that, due to the Agricultural Land Act, they could only sell farmlands to registered farmers who already own their own.

What Should We Do With Farmlands That Are Difficult to Convert? Is Japanese Agriculture Alright?

The rice fields across Route 9 had been rented out to a neighboring tenant farmer after Keiko, their mother, died. Yoko and Shu contacted and visited that person.

In the tenant contract submitted to the Agriculture Committee, Shigeru was supposed to receive a small rent that does not even meet fixed asset tax. When Yoko and Shu mentioned that, the tenant farmer said, “Your father asked me to do rice farming. It was hard for me, but I was doing him a favor. I won’t do it anymore if I need to pay rent.”

After talking with him, Yoko and Shu discussed about the rice field across Route 9 again.

“No rent or rice for us, but we still need to keep paying for the fixed asset tax and land improvement district, right?”

“I would love to sell lands to the younger generation who wants to do farming. But we can only sell to those registered farmers who already have some farmlands because of the Agricultural Land Act.”

“Do you think that the future of Japanese agriculture is alright? I think the numbers of ruined farmlands are going to increase.”

“Since land conversion is difficult, let’s ask the tenant farmer to keep making rice for now. We will think about the future later.”

Submission for the Inheritance Tax Return Is Finally Completed!

After detailed research, Yoko and Shu discovered that they needed to submit an inheritance tax return. A month before the submission deadline, they gathered at Yodoe again from June 20 to 23, 2018.

After contacting the tax office several times regarding unclear points, Yoko created documents with Microsoft Excel. Before the tax office closed on Friday, both of them visited Mr. Kotani in the Yonago Tax Office. He pointed out several mistakes in the paperwork. He explained to Yoko and Shu how to fix them, but the closing time came.

Since they understood their mistakes, they agreed to mail the revised documents in a few days and went home.

During the six months after the father’s death, they faced problems in Japanese agriculture themselves, including vacant lands, land management, and a lack of farmers. Even optimistic people like them felt hopeless about the future of Japanese agriculture.

“Hey, let's wander around the area and eat some delicious seafood since we came this far to Yodoe. We can think about it more later.”

“You are right. I know for sure we will find something we can do.”

They finally mailed documents to the tax office on June 28. After they were approved, they paid the tax.

During these nine months, they learned so much about inheritance.

Next Story: Episode 04 Earthquake and Typhoon Hit Osaka

Right before the inheritance procedure was finished, an earthquake with a maximum seismic intensity of 6-lower (Approximately magnitude 6.1)occurred in northern Osaka. Many transportation systems were shut down. Furthermore, two and a half months later, Typhoon No.21 (Typhoon Jongdari) hit the Kansai region (Osaka and vicinity prefectures)on September 4 of the same year. A major blackout occurred, and many apartments and stores around Yoko’s office lost power for over a week. Since she opened her office for those who needed to charge their electric devices and other items, neighbors occasionally visited her place. This experience drastically changed her thinking about what to do with her parents’ house.

コメントをお書きください